24 May 2023

Company insolvencies are on the increase and are currently running at a year-on-year rate higher than seen before the pandemic?

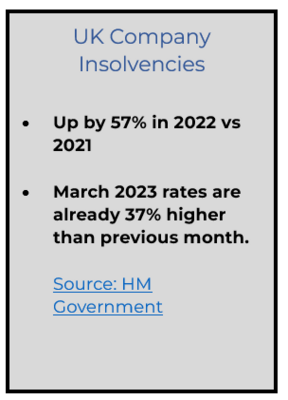

Company insolvencies are on the increase and are currently running at a year-on-year rate higher than seen before the pandemic. There are many factors at play as to the cause of this and some reports point to a combination of the energy crisis, an ongoing recession and rising interest rates. Together these are putting a squeeze on UK businesses. This is not just a UK problem - some economic analysts predict that global insolvencies are set to see double-digit increases in business insolvencies

We consider three key factors you should be looking out for and what you can do to mitigate the risks.

Three things that should put you on alert

1. Have I been paid?

It’s an old joke about the cheque being in the post but you won’t be laughing if you are nervously waiting. Alarm bells should ring if the excuses keep coming. Is your customer disputing or making spurious queries, claiming non-receipt, and generally stalling for time? Have there been changes from the norm. Are they making part payment, requesting a change of terms, or altering their ordering patterns? All could be signs of a company in trouble.

2. How is the business performing?

Look for information in the public domain and within industry circles. For example, have they cut marketing spend or are investors reconsidering their position at the company? Look out for structural and management changes or intel from other suppliers. If they are also feeling the heat, then your concerns could be valid.

3. What do the numbers say?

If the firm is listed, then check their share price - is it falling - and how are the markets reacting? Analysts’ reports and trading patterns will provide insight on how the business is performing over time and also if they are in trouble. This could also include media reports, particularly if there are signs of reputational damage. Examine carefully their financial results, credit rating and insurance claims. If the cumulative results are not good, then you need to act.

What should you do?

Transparency is essential. Get in touch with any customer you are concerned about and seek clarity about what is going on. Other methods you can use to mitigate your risk include:

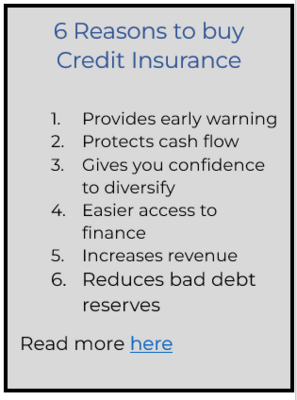

- Take out credit insurance. Not only does this cover you for non-payment, you will have access to market intelligence to help you avoid risks in the first place by spotting high risk companies. Take a look at our recent article that looks into the top reasons to buy credit insurance

- Reducing your exposure by conducting less business with them and broadening your customer base

- Alternatively, renegotiate payment terms with clear and open dialogue and commitments. If they do weather the storm your relationship will be stronger in the long-term.

What next?

At Verlingue we have a dedicated Trade Credit team. If you would like more information on how we can support your business, please contact us now.