29 September 2022

The global Web3 market reached $3.2 billion in 2021 and is expected to hit $81.5 billion in 2030 according to analysis by Emergen Research.

Web3 is often thought of as a new version of the internet that provides a more emersive experience for consuming information and interacting with each other in a more meaningful way.

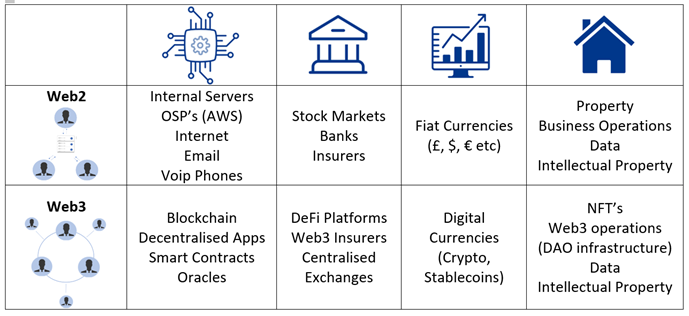

Inspired by blockchain technology Web3 enables us to work using decentralised processes, decision making, providing more control over our digital assets, data and how they are used.

Web3 is better thought of as it’s own economy. One that embodies a wider financial system with the potential to change how all businesses and consumers trade, buy, own, lend and borrow globally

Web3 infrastructures, assets and financial services create new risks and liabilities that companies will need to navigate such as:

- Increased risk of professional laibility and consequential loss

- How to comply with sanctions in an anonomys trading environment

- Greater focus on Intellectual Property ownership

- Theft/loss of digital property

- Theft of NFT/Crypto

- Broader Theft of Data risks from Smart contract logic hacks, ice phishing etc

- Hacking of DOA infrastructure

Companies need to understand and risk assess these threats to mitigate, manage and transfer where possible.

When transfering these types of risks, specialist policies are required with the support of an expert broker in the field to provide understanding, advice and navigation through the process.

Lee Downs Dip CII

Client Director - Tech Sector

Email: Lee.downs@verlingue.co.uk

Phone: +44 (0) 7394 570039