11 April 2022

After over two years of turmoil many businesses are ready to bounce back. To maximise on the opportunities, we consider the supply chain issues and how they impact on trade credit risks – plus what you can do to mitigate against them.

What are the current risks?

We recently identified 7 factors which will influence trade credit risks this year. With the furlough scheme and the government backed trade credit arrangement now closed, the safety net has gone. To put this into perspective it is worth considering a few of the numbers, which are staggering. Over half a million businesses were covered, protecting more than £575 billion of business turnover providing £210 billion in insurance cover.

It comes as no surprise that business failures are on the rise. One report estimates that after two years of decline, insolvencies worldwide will increase by 15% in 2022. Recent Government figures reveal an alarming year on year doubling of insolvencies when comparing this February with last.

Adding to the perfect storm was the removal of winding up order petitions which had been restricted for 18 months, along with businesses taking on more debt in the pandemic. The repayment of bounce back loans and other support schemes has also started. This is before we even begin to factor in the uncertainties created by the war in the Ukraine and Brexit.

What does this mean for Supply Chains?

That cliché about America sneezing and the rest of the world catching a cold translates to the increasingly complex nature of business supply chains.

As an example of this, if you are looking forward to a bright summer and are a tennis fan then you may be surprised just how far a Slazenger tennis ball travels before it lands on centre court in Wimbledon. The journey is estimated at 50,000 miles taking in 11 countries over 4 continents. Just shipping wool from New Zealand to the Cotswolds and then sending the finished felt to the Philippines is an immense serve and volley back and forth around the globe.

Shortages of raw materials, import and export delays, inflation, and rising employment costs as well as fuel have put an increasing strain on the supply chain. One individual example of this can be seen in the cost of shipping containers which have rocketed. One Scottish gin producer found the price soar from $2,500 pre-pandemic to an eye-watering peak of $18,000 this year.

At each point in the supply chain there is risk, and it is likely that the various businesses involved in the chain are assessing the chances of failure by any of the other businesses. In fact, it would make sense for each of them to take out insurance protection.

What can we expect and what can you do about it?

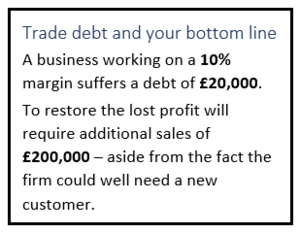

Until 31st March 2022 the threshold for a winding up petition was £10,000, this pandemic related restriction has now been removed. With the shackles off, even more insolvencies can be expected. So, what could this mean in tangible terms for a firm? A business with a debt of £20,000 and working on a 10% margin would need to bridge an income gap of £200,000 worth of sales to restore the lost profit. It is likely that they may need to find a new customer to do this as well.

A Trade Credit policy is an effective way of mitigating this risk. Plus, it can help manage the broader supply chain risks. The insurer gives the policyholder access to a wealth of business intelligence and expertise in credit risk. Together, they can determine the level of credit risk, adjust the level of cover and agree credit limits, consider the financial health of customers and focus on the most profitable.

It is a win-win for the business and insurer.